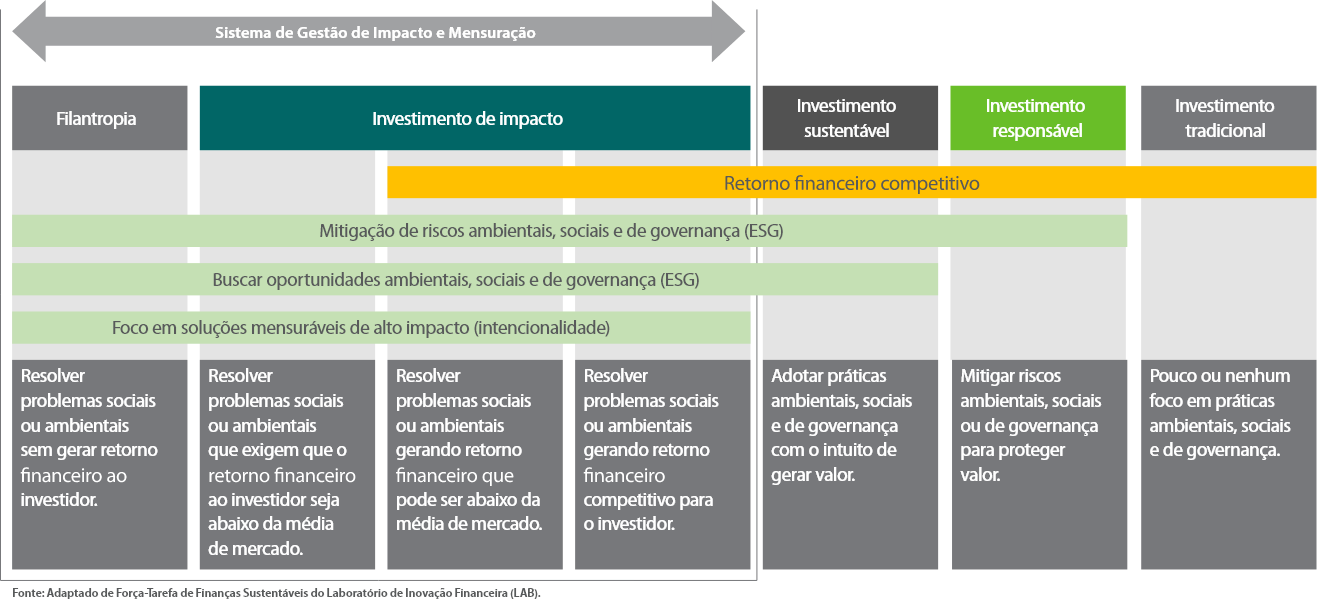

In order to pursue its mission, Fundo Vale has operated with hybrid financing models, ranging from development (non-refundable) to investment (with an expected return). Its first investments were made in line with the logic of traditional philanthropy, through donations.

Based on our early experience, strengthening environmental conservation projects, forest production chains and economic restoration initiatives, we identified the need to connect the social and environmental agenda with impact investments and venture capital.

Thus, we dived into the field of social finance, prototyped and experimented with different economic arrangements, participated in collective investment experiences and modeled financial vehicles to understand how to leverage this sustainable economy using the capital provided by Fundo Vale.